Report Card for Your Credit

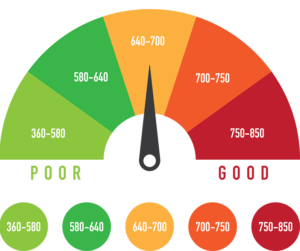

What do a report card and a credit report have in common? A credit report is like a report card for your credit and your credit score is is like your grade for your credit. Lenders review your credit report to determine whether or not to extend credit to you and at what interest rate. Credit scores range from 300 to 850. FICO Scores are the credit scores used by 90% of top lenders. Here is a breakdown of credit scores to see what is considered a good credit score: Less than 580 (Poor/F), 580 – 669 (Fair/D), 670 – 739 (Good/C), 740 – 799 (Very Good/B), and 800 – 850 (Exceptional/A). Visit myfico.com for more information about credit scores.

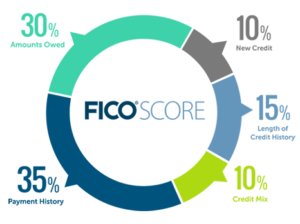

What do a report card and a credit report have in common? A credit report is like a report card for your credit and your credit score is is like your grade for your credit. Lenders review your credit report to determine whether or not to extend credit to you and at what interest rate. Credit scores range from 300 to 850. FICO Scores are the credit scores used by 90% of top lenders. Here is a breakdown of credit scores to see what is considered a good credit score: Less than 580 (Poor/F), 580 – 669 (Fair/D), 670 – 739 (Good/C), 740 – 799 (Very Good/B), and 800 – 850 (Exceptional/A). Visit myfico.com for more information about credit scores. What determines your grade on your credit report card? Your credit report consists of information in five categories: Payment History (35%) Payment history shows how you have paid your accounts. Have your payments been on time or late? Amounts Owed (30%) Amounts owed has to do with how much total debt you owe. Also, if you have revolving credit how much available credit do you have. Length of Credit History (15%) Length of credit deals with how long your credit accounts have been open. There is focus on the oldest account(s) and the newest account(s). Credit Mix (10%) Credit mix is the types of credit you have used. This includes credit cards, retail accounts, installment loans, and mortgages. And New Credit (10%) New Credit focuses on new accounts and credit inquiries within the past 12 months.

What determines your grade on your credit report card? Your credit report consists of information in five categories: Payment History (35%) Payment history shows how you have paid your accounts. Have your payments been on time or late? Amounts Owed (30%) Amounts owed has to do with how much total debt you owe. Also, if you have revolving credit how much available credit do you have. Length of Credit History (15%) Length of credit deals with how long your credit accounts have been open. There is focus on the oldest account(s) and the newest account(s). Credit Mix (10%) Credit mix is the types of credit you have used. This includes credit cards, retail accounts, installment loans, and mortgages. And New Credit (10%) New Credit focuses on new accounts and credit inquiries within the past 12 months. Now that you know about your credit report and how credit scores are determined, you can review your credit report and get your credit score. Your credit score can change as information on your credit report changes, including payments, new and paid off credit, and credit balances. You have a right to receive a free credit report from the three credit bureaus (Equifax, TransUnion, and Experian) every 12 months from annualcreditreport.com. These credit reports do not include your credit score but it’s important to know what’s on your credit report to see what makes up your score. There are several sites that offer you your credit report for free or for a fee. Either way, you can determine whether your score is high or low. Your credit score is an important part of your money management journey. All the best.

Now that you know about your credit report and how credit scores are determined, you can review your credit report and get your credit score. Your credit score can change as information on your credit report changes, including payments, new and paid off credit, and credit balances. You have a right to receive a free credit report from the three credit bureaus (Equifax, TransUnion, and Experian) every 12 months from annualcreditreport.com. These credit reports do not include your credit score but it’s important to know what’s on your credit report to see what makes up your score. There are several sites that offer you your credit report for free or for a fee. Either way, you can determine whether your score is high or low. Your credit score is an important part of your money management journey. All the best.Click here to buy a copy of my ebook: Money Management 101