Rule of 72 a/k/a Banker’s Rule – How Come Nobody Ever Told Me About This?

The Rule of 72 is a concept that has been hidden in plain sight for years. Few people still know about it but bankers have known about it for years! How come banks do not tell you about the rule of 72? All bankers do not know about this rule. In all fairness, I did not know about this rule and did not learn it from my experience in banking. Personal Bankers and Branch Managers do not know about this rule, but I guarantee you that those in charge of investing the bank’s money know this information. And if they shared this information with the general public, it is possible that their deposit base would shrink significantly!

The Rule of 72 is a concept that has been hidden in plain sight for years. Few people still know about it but bankers have known about it for years! How come banks do not tell you about the rule of 72? All bankers do not know about this rule. In all fairness, I did not know about this rule and did not learn it from my experience in banking. Personal Bankers and Branch Managers do not know about this rule, but I guarantee you that those in charge of investing the bank’s money know this information. And if they shared this information with the general public, it is possible that their deposit base would shrink significantly!

The Rule of 72 is a rule that has been around for over 200 years. It is a simple calculation that gives you the approximate number of years it may take to double your investment. Below is a hypothetical example:

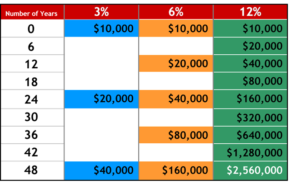

Based on The Rule of 72, a one-time contribution of $10,000 at 3% would double every 24 years (72/3 = 24). A one-time contribution of $10,000 at 6% would double ever 12 years (72/6 = 12). A one-time contribution of $10,000 at 12% would double every 6 years (72/12 = 6). It is called the Banker’s Rule because if you deposit a one-time contribution of $10,000 in a bank at 3% it would take you approximately 48 years for your money to get a return of $40,000. The bank takes your $10,000 and invests it at 12% or more and gets a return of $40,000 after only 12 years (see chart below). At the end of 48 years, the bank gives you $40,000 but has gotten a return of $2,560,000 using your money! $2,560,000 – $40,000 = $2,520,000 for the bank! Does that seem fair? If you do not know the rules of the Money Game and do not know how to get a 6% or 9% or 12% return, then you are making the bank rich with your money. Which would you rather have at the end of 48 years, $40,000 or $2,560,000?

This table serves as a demonstration of how the Rule of 72 concept works from a mathematical standpoint. It is not intended to represent an investment. The chart uses constant rates of return, unlike actual investments which will fluctuate in value. It does not include fees or taxes, which would lower performance. It is unlikely that an investment would grow 10% or more on a consistent basis, given current market conditions.

Click here to get my free eBook: Money Management 101